Boulder's #1 Choice For Home Loans

Get A Free Copy Of The Official Boulder County Home Buying Guide:

By providing my phone number, I agree to receive occassional SMS messages from Boulder Home Loans.

FOR THE PEOPLE'S REPUBLIC OF BOULDER

Our Mission Is To Provide Expert Mortgage Advice to Boulder County Residents

22

YEARS OF

EXPERIENCE

1000+

HAPPY CUSTOMERS

IN COLORADO

156

VETERAN FAMILES HELPED

WITH NO DOWN PAYMENT

37

FIVE STAR REVIEWS ON

GOOGLE AND ZILLOW

WHY CHOOSE US

We Love Boulder, Like You.

Getting a home loan or refinance in Colorado doesn't have to be complicated or difficult. We provide low rate mortgages with no hassles during the home buying process. Get started today.

Professional Advice For First Time Home Buyers in Colorado

Your home is a sanctuary where you can always escape to feel safe in your own space

Refinance Your Home With No Out of Pocket Expenses or Fees

Equity can be used for real estate investing, paying off debt or even for a college fund

Competitive Mortgage Interest Rates With Flexible Options

We shop your home loan with over 100 options to find the absolute best deal

Special Home Loan Programs for Military and First Responders

This is our way of saying thank you to vetarans and first responders in Boulder

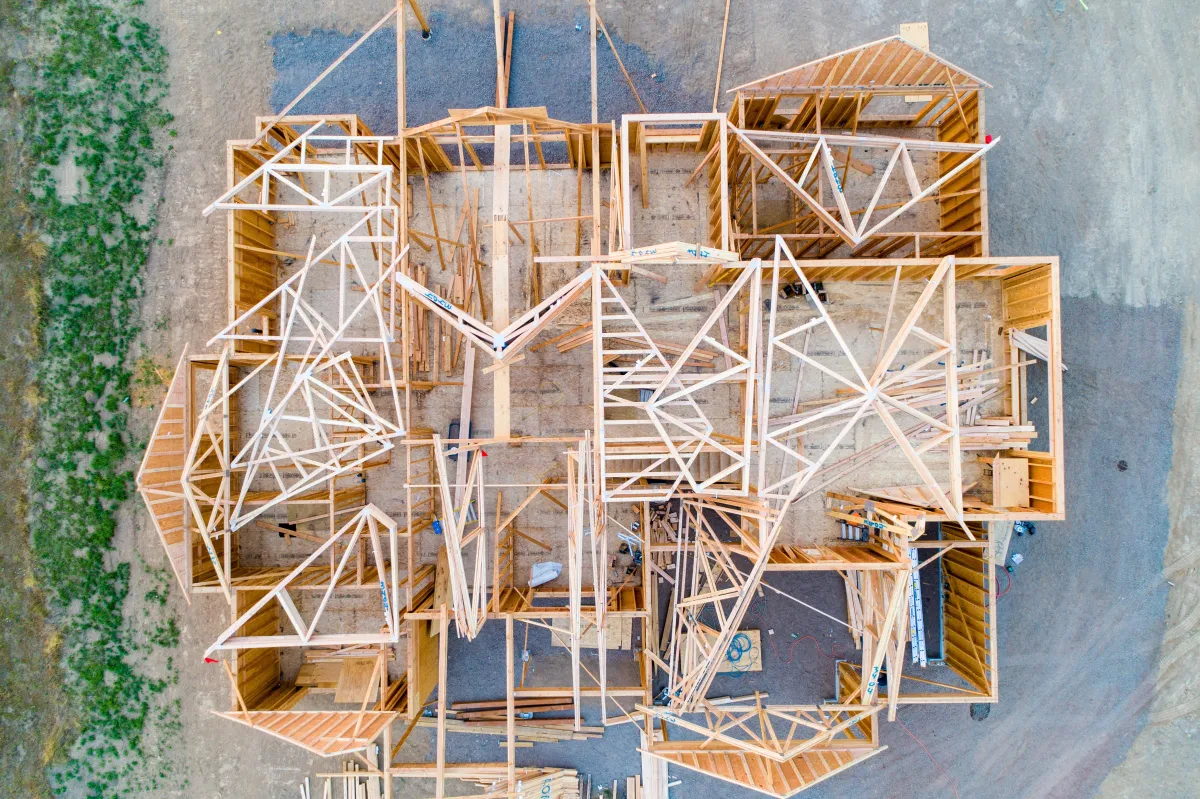

Build Your Dream New Construction Home in Colorado

Find raw land with awesome views and build using our new construction loans

Investing In and Supporting Our Local Boulder Community

We support several non-profit charities and organizations in Boulder County

Mortgage Pre-Approval

Fast approvals so you can find the house of your dreams in Boulder before anyone else

House Shopping

Expert Realtor relationships to connect you with the perfect real estate agent you'll love

Complete The Process

Buying a home in Boulder is easy when you have local professionals in your corner

WHAT’S THE BEST BOULDER CO HOME LOANS?

Mortgage Programs

We serve Boulder County residents with pride to help you get financing for your next home, refinance your existing house or create generational wealth through real estate investing

We're Old School in a Tech World, Let's Start With a Phone Call

The best way to get a new home in Boulder is to start with a quick 15 minute phone chat so we can understand your goals and create a plan together that makes sense for you. We'll consider...

Your ideal timeline to move to your new house

Your current job(s) and sources of income

Your savings, investments and down payment options

Your longterm goals for this property in the future

THE MORTGAGE PROCESS

Getting a Home Loan in Boulder, Colorado

Buying your first home in Boulder is fun if it's done in the right order and you get pre-approved for a home loan before going out shopping with a local Realtor for a house so you know the monthly mortgage payments when you write an offer to purchase the house you love.

Mortgage Pre-Approval

The first step for any home buyer in Boulder is to get pre-approved for a home loan and you can start that now right here.

Hire a Local Boulder Realtor

You are ready to go shopping and find the home you want to buy once you know what your monthly payments will be.

Here Are The Top 10 Most Common Questions About Boulder CO Home Loans

These answers were provided by some of the top Mortgage Advisors and Realtors in Boulder County

How much can I afford to spend on a house?

Start by looking at your current housing payments and your existing debt obligations (such as student loans, car loans, and credit card payments). How does that all feel? Do you have leftover disposable income? Could you bump up your monthly payment a little bit if you owned the house? We never want to see clients house poor where all you can afford to do is live there and not enjoy it.

How do I get a mortgage?

Getting a mortgage starts with taking a close look at your income, expenses, savings, and credit score. This will help you determine how much you can afford so you have an idea when you chat with a Loan Officer. A licensed Mortgage Advisor will use different factors like your credit, income and debt-to-income ratio to determine how much money they will let you borrow to buy a house and what your monthly payments will be for that amount.

What are the different types of mortgages?

There are several types of mortgages available to people in Boulder including FHA loans, VA home loans, Conventional loans, USDA home loans and some other specialty loans available to some industries, situations and locations like first responders or rural properties. Downpayments range from 3% to 10% for most people but can be as low as 0% down.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

The main difference between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) is how the interest rate is structured. The interest rate remains the same fo the entire duration of a fixed reate mortgage. This is usually 15, 20 or 30 years. Adjustable rate mortgages or ARM Loans have an interest rate fixed for a certain period od time like 5, 7, or 10 years. After the fixed-rate period ends, the interest rate adjusts periodically based on a specified index, such as the U.S. Treasury rate or the London Interbank Offered Rate (LIBOR). The adjustment frequency can be annually, semi-annually, or even monthly. When the rate adjusts, your monthly payment may increase or decrease accordingly.

How can I get the best mortgage rate?

Like many other financial options, mortgage rates can vary greatly depending on how safe or risky a loan to you feels to the lender. To get the best mortgage rate in Boulder CO, you can take several steps including improving your credit score, saving for a larger down payment, and improve your debt-to-income ratio. Remember, getting the best mortgage interest rate is a combination of improving your financial profile and being proactive in your approach.

What are the terms for a mortgage?

Different terms of a mortgage include the loan amount, interest rate, the length of time over which you will repay the mortgage, down payment, and the closing costs which include various fees associated with finalizing the mortgage loan and transferring ownership of the property. Understanding your mortgage terms is important when evaluating different loan options.

What is the process of getting a mortgage in Boulder CO?

The easiest way to start the process of getting a mortgage is to schedule a free 15 minute phone consultation so our top rated Boulder CO Mortgage Advisors can help you create a plan of homeownership. Knowing what you are qualified for before shopping for a home brings so much peace of mind and makes you competitive with cash offers.

How much can I borrow for a mortgage?

How much you can borrow for a mortgage depends on various factors, including your income, creditworthiness, debt-to-income ratio, down payment, and specific lender's criteria. Lenders typically look at your income to determine your borrowing capacity. A general rule of thumb is to have your debt-to-income ratio (DTI) below 43%. It's important to note that while lenders may offer you a certain borrowing limit, you should also carefully consider your financial situation, including your monthly budget, lifestyle, and long-term financial goals before deciding the loan amount you are comfortable borrowing.

How do I apply for a mortgage?

Here are the steps to apply for a mortgage:

1. Prepare Your Finances: Gather all relevant financial documents, such as pay stubs, W-2 forms, tax returns, bank statements, and documentation of other assets or debts. Organize these documents to provide accurate and up-to-date information during the application process.

2. Get Pre-Approved: Getting pre-approved for a mortgage is the step before going out to shop for a home. Pre-approval provides an estimate of how much you can borrow, allowing you to search for homes within your budget. Pre-approval typically involves submitting your financial information and supporting documents to the lender for evaluation along with having your credit report pulled.

3. Submit Required Documentation: Along with the application, you'll need to submit supporting documents to verify the information provided. These may include income documents (pay stubs, tax returns), identification (driver's license, passport), bank statements, and any other documents requested by the lender.

The specific mortgage application process can vary depending on the lender, loan type, and other factors. It's essential to maintain clear communication with your lender and provide any requested information promptly to ensure a smooth application process.

Are there any special home loan programs I might qualify for?

There are special financing options for active duty military members, veterans, first responders, nurses and hospital workers and several other specialties. Grab a time to chat if you want to find out which ones would be the best to help you buy a home in Boulder.

What our customers say about us!

Danielle Escobedo

First Time Homeowner

We contacted Boulder CO Home Loans from the recommendation of our Realtor Tony. They made the whole process easy and I really loved that they Zoomed with us a few times to check in!

Susan Fieke

Military 0% Down

I heard about the VA Loan but wasn't sure how to use it to get a house. The team at Boulder Home Loans were nice to work with. I need some business cards to give to my friends. You have my address lol.

Bobby Wisniewski

Used some equity

I wanted to pull some of my home equity out to use it for a down payment on an investment home and Boulder Home Loans got it done quickly with no money out of pocket.

Book a 15 Minute Home Buying Consult

Office:

Boulder, Colorado

Call

720-912-5433

Email:

team@bouldercohomeloans.com

NMLS:

12345